Our investment principles

AfterWork Ventures is a sector agnostic fund. We believe there are six characteristics that are common across all companies on a trajectory from anomaly to icon.

We have sunsetted the AfterWork Ventures Substack. The original post can be found on our website here.

When we’re asked what kind of companies we invest in, we usually say “we are sector-agnostic and we invest in all kinds of businesses”. Rather than specialising in any one vertical, we apply the same six investment principles to all investment opportunities.

When we discuss investment opportunities as a community, we debate whether a startup clears the bar across these six dimensions:

1. You are seeking to put a dent in the universe

As a venture capital fund, we have to invest in venture scale opportunities. This means all investments must independently be capable of returning the entire fund (an 80x - 100x return). We want to back founders who are ambitious about their companies’ end-state, and have a clear conception of what their end-state looks like. For example, they should know how many customers they have, who they are, and how much value their product is creating for those customers. Additionally, they can describe the vectors of product and geographical expansion that will deliver $100m+ in annual revenue. They also understand how each step in their roadmap strengthens their ability to deliver on their next phase of growth.

When it comes to building a venture scale company, not all markets are created equal. We believe it’s easier to reach $100m in annual revenue where there is a large addressable market, particularly one that’s ripe for disruption, or enjoying some other tailwinds. This doesn’t mean we get caught up in fabricated market sizing, but we need to be convinced that there are enough people who will derive value, and are willing to pay for, the product you are building.

2. You have an outsized spike in one area, and are rallying a formidable team with complementary skills

We are excited to back maniacally focused founders who have thought clearly about the future they’re building and why they're the best positioned team to execute on their big idea. Traits of founders we love include: a big, clearly-articulated ambition, an ability to rally people around their vision, organisational discipline, a learn-it-all disposition, and a deep understanding of the customer they’re building for.

It’s rare for a founder to be well-rounded across all these traits. Most commonly, founders have a clear spike in a couple. Therefore, we love founders who reflect on their own strengths and shortcomings, identify the gaps in their skillset, and build teams with complementary skills.

Founders sometimes get all of the credit for a company’s success, and undue attention is paid to them during the due diligence process. However, we believe that the success of a business depends on all its people, so we want to back founders that are assembling teams of formidable operators, all bought into a common mission. If the team is yet to be hired, we want founders to be able to describe exactly who they want their next five hires to be, and how they’re going to convince those rockstars to join.

Mitchell Stevens, the co-founder and CEO of Wagetap, is an example of a founder who earned our admiration. Mitch is a non-technical founder with outsized spike in inspirational leadership and organisational discipline. Most impressively, Mitch had considered, with remarkable precision and clarity, the skills he needed to round out his founding team. He knew the operators who possessed the desired skills and disposition would be in demand at every startup. Indeed, the operators he approached had enjoyable jobs at leading tech companies, such as Atlassian, Canva, Deputy, and AWS. Methodically, he got to know them and what drove them: what their career ambitions were, what kind of work energised them, what they found lacking in their current roles. Then, he designed each role to empower the operator to do their best and most energising work. Mitch has been able to coalesce an all-star team who are now achieving fantastic things together.

3. You are building a product for the ages

Although we don’t expect early versions of products to be perfect, we admire beautifully crafted products that are intuitive and delightful to use. We like to back founders building products that are truly original, and we want to be excited by the long-term product roadmap.

When we evaluate products, we consider the speed at which it’s being shipped, the effective prioritisation of features, the thought that’s gone into the way the customer will interact with the product, the craftsmanship and durability behind the design, and the moments of ‘delight’ built into the customers’ experience of the product.

An example of a product we admire is Who Gives A Crap, the maker of sustainable, direct-to-consumer toilet paper rolls. Anyone who’s ordered and received a WGAC parcel knows that it’s a seamless experience speckled with moments of delight; every step in the toilet paper ordering and consumption process is injected with ease and levity. As a result, WGAC has been able to create loyal customers in an otherwise commodified category.

4. Your customers’ friends are sick of hearing about you

The teams we invest in are deeply attuned to their customers’ and users’ day-to-day problems and want to make their lives better. These teams have a deep understanding of the problem causing their customers pain, and are bringing a fresh and unique perspective to solving it.

In our due diligence, we gauge whether founders can clearly articulate the company’s proposition from the customer’s perspective, and whether they make this perspective core to all decisions made at the company. We also test for an understanding of how customers think as they make their purchasing decisions, where they get information from, and what it takes to convince them to purchase the product.

In turn, when we interview a company’s customers during our due diligence process, we want to hear that customers are raving about the product to their friends and family, or can’t wait to get their hands on it, and would be genuinely crushed if it went away.

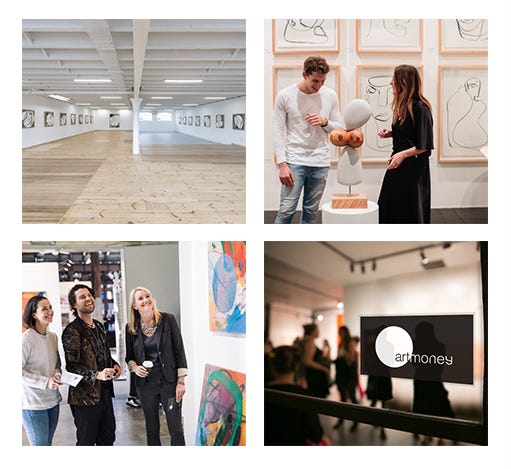

The customer love that we uncovered was a key reason for our investment in Art Money, a financing solution for art purchases. In our due diligence we interviewed a dozen art galleries, and their endorsements were nothing short of gushing. One gallery attendant told us that Art Money had enabled her to start building her own art collection; a source of great pride and joy. Another shared with us that Art Money had enabled a customer to finally take home a painting that they had returned time and time again to admire.

Art Money is an intrinsically customer obsessed organisation, and are differentiating themselves from other finance providers by creating more value for users through access and liquidity than they extract. As one gallery owner put it: “They’re doing this because they’re passionate about art, and they want to democratise access. They’re not interested in scalping borrowers for late fees”. We loved that Art Money was seen as more than a financing solution, but as playing an important role in facilitating purchases that sparked joy and enriched people’s lives.

5. You’ve created a machine generating its own momentum

Investments excite us when teams are achieving significant progress and momentum, and we have an opportunity to add fuel to the engine.

The best early indicator of a successful business is momentum. As in physics, momentum has two dimensions: velocity and mass. Early signs of ‘velocity’ could look like strong and growing month-on-month revenue, a healthy proportion of users engaging with the product regularly, or many wins in a short period of time. Early indicators of ‘mass’ are harder to pin down, but could look like a credentialed and experienced team, a big and growing addressable market with some serious tailwinds, and a compelling vision that is resonating strongly with customers and prospective hires.

Arli is a company that has momentum through ‘mass’. The team are tackling a huge problem (addiction) and are reimagining rehabilitation through curating online communities of peers fighting addiction together. The Arli team have serious skin in the game: all of them have been affected by addiction; some have lost relatives. Each day, their mission is to give every person fighting addiction a pathway to purpose. It is evident that Sally (Founder and CEO) is summoning every last ounce of energy she has to work on her life’s mission; her passion is as palpable as it is resonant.

6. You’re making it work on the smell of an oily rag

Capital efficient companies are able to make swift and iterative changes in their product development, business model, and go-to-market strategies with limited resources. Generally, capital efficient companies are able to grow much faster than companies that are capital intensive, and are able to experiment and course correct where needed. Additionally, founders and early-stage investors are able to maintain a greater share of equity in capital light companies, as large, dilutive fundraises are not required at the early stages. What constitutes ‘capital efficient’ is changing over time, as technology evolves. This means we consider, and have made, investments in industries that have been traditionally thought of as capital intensive, such as consumer hardware and robotics. In these cases, we’ve been confident that product development and customer growth can occur at a pace equivalent to the growth of software solutions, using limited capital.

In particular, we admire founders who, through their own resourcefulness and ingenuity, are able to outpace better resourced, better funded incumbents in bringing new products to market. A company we admire is Ripe Robotics, who developed and brought to market working models of robots that can harvest apples and oranges with less than $100k. To put this in perspective, Ripe’s competitors in the US have spent millions to develop machines that pick fruit at roughly the same rate and accuracy.

The matter of timing

Early stage startups only have a short window to achieve momentum. Without momentum, everything becomes difficult: raising funds, hiring top talent, and keeping the team motivated. Whether a startup can achieve early momentum is not purely within the control of a given company; some ‘windows of opportunities’ will significantly skew luck in a company’s favour. This means that startups can’t be assessed on their merits in a ‘vacuum’ - the analysis must always be connected to a robust and nuanced understanding of overarching waves of disruption.

Our community of diverse operators, who hail from different sectors and functions, constitute our ‘edge’ when it comes to evaluating opportunities against the backdrop of larger thematic trends. Working together with community members, the AfterWork partnership are constantly working to understand and articulate the ‘future of’ given industries.

Above all else, when we assess opportunities, we don’t wait for conviction to hit us over the head. We know that brilliance comes from non-obvious places, and we’re happy to contort ourselves into a position where we can see the world from the founders’ perspective.

Know a team who embodies all these principles? Introduce us!

Fantastic article - thanks! As a founder it's awesome to have a well articulated checklist like this for all this shit we should make sure we're doing.