Hello World! We're AfterWork Ventures.

We're a new community-powered VC fund, investing early stage in ANZ startups.

We have sunsetted the AfterWork Ventures Substack. The original post can be found on our website here.

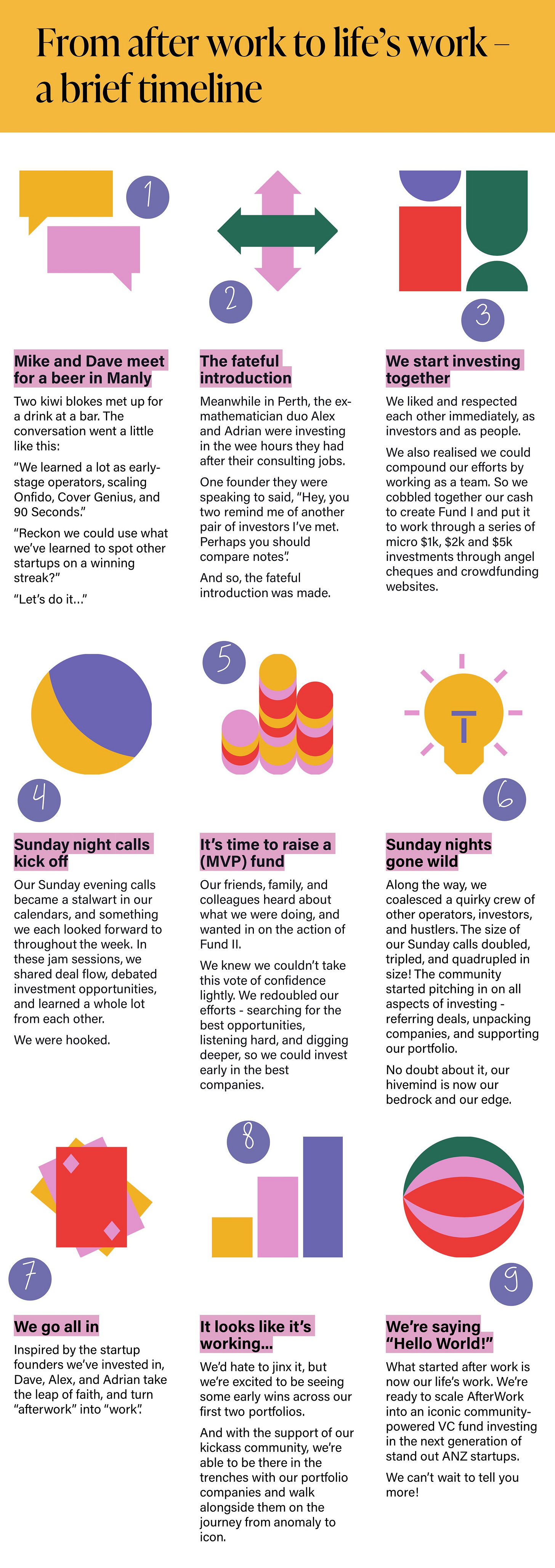

AfterWork Ventures started as a side-hustle, in the wee hours we had after work. As we strolled along our respective corporate paths, we found ourselves hankering for interesting side projects, and wondering how we could contribute. Again and again, we were drawn to the dynamism of startups, and inspired by the audacious visions of their founders. We wanted to get to know these teams and use our skills to help them shake things up.

We saw that access to capital was a major barrier for startup founders, particularly at the earliest stages of their journey. We wanted to support startups with their capital needs, and then walk alongside them on the long, arduous, and at-times lonely path from improbability to outlier success. As outsiders, we weren’t privy to a ‘playbook’ on how to be venture capitalists; so we wrote our own. In doing so, we saw opportunities to intentionally reimagine some elements of the industry we found a bit wonky.

For example, we kept seeing early stage founders subject to hellish, drawn-out due diligence processes, only to be unceremoniously knocked back despite their efforts. In response, we designed a founder experience imbued with respect and efficiency at every turn, and made an ongoing commitment to ‘turn up’ for founders in a manner which honours their time, intel, and courage. Additionally, we knew we’d inevitably say ‘no’ to most investment opportunities, so we committed ourselves to ‘saying no’ in the most truthful and useful manner we can. Lastly, we saw the need to plug a gap in the market: globally, and in Australia and New Zealand in particular, pre-seed and seed-stage investment has fallen for three consecutive years. We decided to back founders at this early stage, when their brilliance is difficult to quantify.

As word spread about what we were doing, we started hearing from others who shared our passion for startups and wanted skin in the game. Before we knew it, we’d amassed a motley community, defined by our shared goal to invest in the most incredible startups, and our shared values of transparency, openness, humility, curiosity, and unbridled enthusiasm.

Today, our community comprises a quirky bunch of startup operators, developers, writers, designers, marketers, corporates, and reformed lawyers. In pooling our diverse skills, functional knowledge, and networks, the Afterwork community allows us to punch above our weight in the quality of our dealflow, the incisiveness of our due diligence, and the breadth of support we can provide to our portfolio companies. The community added a vibrancy and depth to our lives that we didn’t know we’d been missing; everyday it nourishes and enriches our professional and personal lives.

The community also gives us access to perspectives sorely lacking from most investment committees: coders, UX designers, big brand marketers, seasoned corporates, Instagram influencers, cryptocurrency traders, and our personal favourite - unproven mavericks with hunger in their belly and a unquenchable thirst to learn. Our hivemind has become both our bedrock and our edge. The majority of our community members have also become LPs in the AfterWork fund; they are bullish about our collective power to source, understand, and invest in the best deals.

What began after work is now our life’s work: Afterwork Ventures is how we will amplify the impact of the next generation of companies building brighter futures, and work with founders to construct sustainable legacies that people are proud to have contributed to. We couldn’t be more excited.

To follow our journey, check out our website and follow us on Twitter.

Please indulge us in a humblebrag

We can’t always predict the future, but we are excited to partner with the people who are building it. Our success is defined by that of our portfolio companies, and we’re so insanely proud of what we’ve achieved together. Since the time of our initial investment, we’ve seen Onfido raise a $100mn Series D round; Cover Genius assist over 200,000 customers to find the right insurance policy, and some of the most impressive VCs in the industry join us on the cap tables of our investments.

While it’s too early to throw a celebration, we’re feeling good about what we’ve achieved. Three of our Fund I investments are IPO-bound, and five of our Fund II portfolio companies have tripled their annual revenue YoY since time of investment. Check out our portfolio here.